Our Friends at Aviation Tax Consultants published a recent brief regarding year end tax planning that included this excerpt. You can view the full document here.

2014 Aircraft Acquisition

2014 Aircraft Acquisition

If you are in the market for a business aircraft, time is running out o complete a purchase for 2014. Dealer

inventory is running low for new aircraft. Pre-purchase inspection and repair of squawks may ad to the

time line for the closing of a used aircraft. If financing is required, you should be get pre-aproved

immediately.

In order to begin depreciation in 2014, an aircraft has to be placed in service before December 31, 2014.

Signing a contract or making a deposit wil not satisfy the placed in service requirement. You should have

legal tile to the aircraft and the aircraft should be available to fly in order to met the placed in service

requirement.

2014 vs. 2015

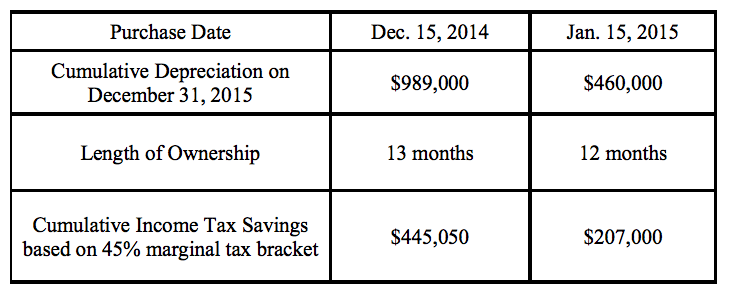

Even without tax incentives like bonus depreciation or Section 179 Expensing, it is advantageous to

complete a purchase and place the aircraft in business service in December. The purchase of the aircraft

will be subject to MACRS (double declining balance) method of depreciation. The following table

illustrates the depreciation deductions available for a 2014 and 2015 purchase of a Piper Meridian at $2,300,000.

Looking Ahead to 2015

The November election results generated some optimism regarding the renewal of some critical income tax

incentives that business aircraft owners have ben accustomed to in recent years. However, it appears that

no tax legislations will be passed by the lame-duck Congress until December, at he earliest.

50% bonus depreciation for new aircraft and $50,00 Section 179 Expensing for new or used aircraft are

both expected to be in the tax extender legislation (S.260 Expiring Provisions Improvement Reform and

Efficiency (EXPIRE) Act. Obviously, it is far from certain that the President will sign the tax extender

legislation. ATC will be monitoring the development closely in the next few weeks. Please check our

website for the latest updates.

——–

Summary:

There are advantages to purchasing now and new legislation if it comes into affect will possibly enhance your situation even further.

LifeStyle Aviation in celebration of and to draw attention to our name change are offering year end specials on select aircraft. Call 406-359-1669 for details!